Content

Liquidity sweeps are a powerful tool for identifying potential reversals and trapping retail traders. By understanding how the market targets liquidity pools, such as equal highs or lows, traders can align their strategies with smart money movements. However, liquidity sweeps are not foolproof and should be used alongside proper risk management and other https://www.xcritical.com/ technical analysis tools.

How Liquidity Crisis impact markets micro- and macro-structure

Above the high of ICT dealing range area is referred to as buy side liquidity, and the resting liquidity below the low of ICT dealing range is sell side liquidity. It is also possible that market may sweep the liquidity before continuing its trend. The perceptions of those zones remain in tune with the changing market conditions and the shifting behaviour what is buy side liquidity of participants since the updating is constant. Keeping an eye on changing liquidity maximizes opportunity around confirmed zones.

Elements of a Smart Money Trade Setup: Complete ICT trading Strategy

If you’d like to learn more about these concepts, take some time to watch the below video that we put together with our friend, Trade For Opportunity. In the video, he highlights all of the concepts discussed above, as well as shows examples of each concept occurring on the chart. Determining where and how to draw a Fibonacci sequence can be tricky, which is why one of the most popular ‘Auto-analysis’ tools on the TrendSpider platform is the Auto-Fib drawing tool. To utilize this tool, simply click on the ‘Auto Fib’ button in your top toolbar and a Fibonacci sequence will be drawn on the most recently completed move per the time frame selected.

How does institutional trading influence market mechanics?

In Bearish Market structure, we expect price to test PD array in Premium area. In Bullish Market structure, we expect price to test PD array in Discount area. The indicator will provide you with two hidden plots to mark the next Buyside or Sellside liquidity levels to use in your automated trading strategy. As in the picture above you can see the equal highs which are termed as buy side liquidity.

Comprehending how these market makers operate opens the door to potentially predict, with greater accuracy, the dynamic rhythms of the Forex market. A liquidity sweep is a market move where price briefly surpasses a key level, such as equal highs or lows, to trigger stop-loss orders or breakout trades before reversing in the opposite direction. It occurs when the market seeks liquidity from retail traders before continuing or reversing a trend. In an uptrend, price forms equal highs or lows, the break of price above and below is considered as trading opportunity on that side. Market makers often push the price slightly above these equal highs to trigger the buy orders, then immediately reverse the price with strong selling pressure. This rapid reversal catches retail traders off guard, trapping them in losing positions.

The framework is useful for assessing what the potential risk/reward could be between the fluctuations within the cycles. One key aspect of ICT is identifying institutional footprints within the markets, which involves closely monitoring the actions of big players, such as market makers and hedge fund firms. Forex liquidity is primarily driven by major financial entities, such as central banks and investing companies, accounting for over 90% of the daily trading volume in the market. An approach used by Autowhale, a crypto market making company, is to leverage order-flow imbalances as well as the arrival frequency of such orders.

In the past, investment managers may have been concerned about interacting directly with market makers’ proprietary risk books. However, this has changed in recent years, as buy side firms sought to avoid market impact that is found in the anonymous, central limit order books (CLOB) on the public exchanges. These include stop losses, retail investors, price changes, and the main roles of buyers and sellers in the market. Conversely, selling liquidity refers to a point on the chart where long-term buyers will set their stop orders. Traders frequently make incorrect predictions in areas where they find these points. Trading liquidity sweeps involves significant risk, as market conditions can change unexpectedly.

In the ICT and other methodologies, liquidity holds immense significance. Monitoring sell side and buy side liquidity levels is crucial for predicting market shifts. ICT traders monitor the market sessions and look for specific times when trading volume is high enough to move prices quickly. This time is known as the “killzone,” and it’s where traders like to place their buy or sell orders.

They provide liquidity to the market by placing buy orders, which allows other market participants to fill their sell orders more readily. These entities strategically deploy capital to influence Forex market movement and leverage trends to their benefit. Buy side liquidity forex refers to the presence of buy orders, particularly above market price ranges or highs, that are awaiting execution. This includes orders like sell stop losses and buy stop limit orders, which play a significant role in the dynamics of institutional trading and overall market mechanics.

For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. So to be a profitable trader you should know and spot the liquidity in market and try to go with flow of market makers. These levels are deemed to contain sell side liquidity due to the concentration of pending sell orders.

- The sell side entails underwriting new issues, making markets, sales/trading, investment banking advisory work, and investment banking research distribution.

- The clustered stopping zones above evolving resistance can be especially revealing of shorts if they are broken in a manner that sparks short-covering-driven accelerations higher.

- Their presence ensures smoother price transitions and can often signal or trigger large market movements when these orders are activated or targeted by buy side liquidity providers.

- In the past, EMSs could not consume the volume of ELP quotes, but technology has advanced.

- In trading market context, liquidity refers to how easily an asset can be bought or sold without significantly affecting its price.

Finding liquidity zones sets the stage for planning strategic manoeuvring. When the accumulation and distribution territories take form, the traders can position themselves relative to those concentrations. A sharp increase in volume around key levels can indicate a potential breakout, which can lead to the price moving further into the liquidity zone.

This article will define the buy and sell sides, explain the concept of liquidity, and explore how liquidity works in practice. ICT is an approach that strives to decipher the intricate dynamics of the markets, as well as replicate the behaviour of astute institutional investors. The integration and application of ICT trading concepts can deliver a substantial boost to a trader’s performance. Liquidity is an important concept in trading, and it becomes even more crucial when applying the principles of ICT to your trading strategies. In simple terms, liquidity refers to the ease with which a particular asset can be bought or sold without affecting its market price.

It serves not just as a metric of trade volume but as the linchpin in forecasting the ebbs and flows of price trajectories. Grasping the synergy between liquidity and market momentum informs a trader’s strategy, providing valuable insights into potential shifts dictated by buying and selling pressures. Liquidity is the first, and arguably the most important concept within the ICT trading methodology.

The amount of professionalism, institutions or market makers acting on a market are the biggest driving factors of market resiliency. Conversely, mostly retail driven markets are traditionally harder impacted by such crisis and have a harder time coming back and regaining strength. Historically Asian (especially Chinese) market participants were driving prices. Hence an increase in trading activity and liquidity was recorded during daytime in Asia. To make the connection to the macro-structure, big changes in liquidity that are news caused, directly manifest in markets microstructure. In this scenario, buy-side firms gain access to bilateral liquidity via their EMS, which would consolidate bilateral liquidity streams from multiple ELPs into one place.

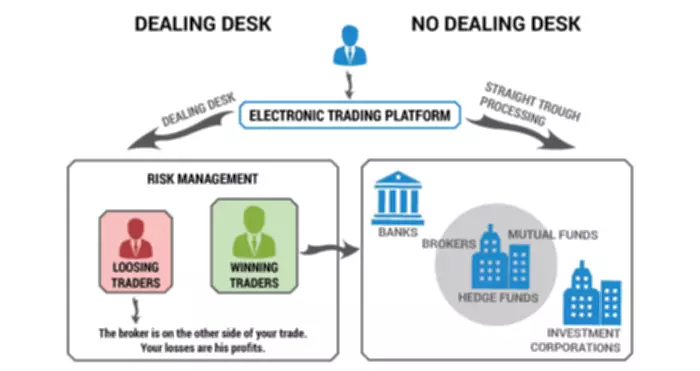

Sell side liquidity offers clues about potential pivot points by understanding how prevailing market participants have strategically hedged their risk. Its monitoring adds context for traders when seeking entry/exit spots around imminent support levels. The buy side encompasses institutional investors like hedge funds, pension funds, and asset managers who purchase securities. The sell side refers to brokers, banks and other firms involved in issuing and trading assets. Both sides interact to facilitate markets, with liquidity emerging from their aggregate activities.